Trusted virtual cards for ads and online payments

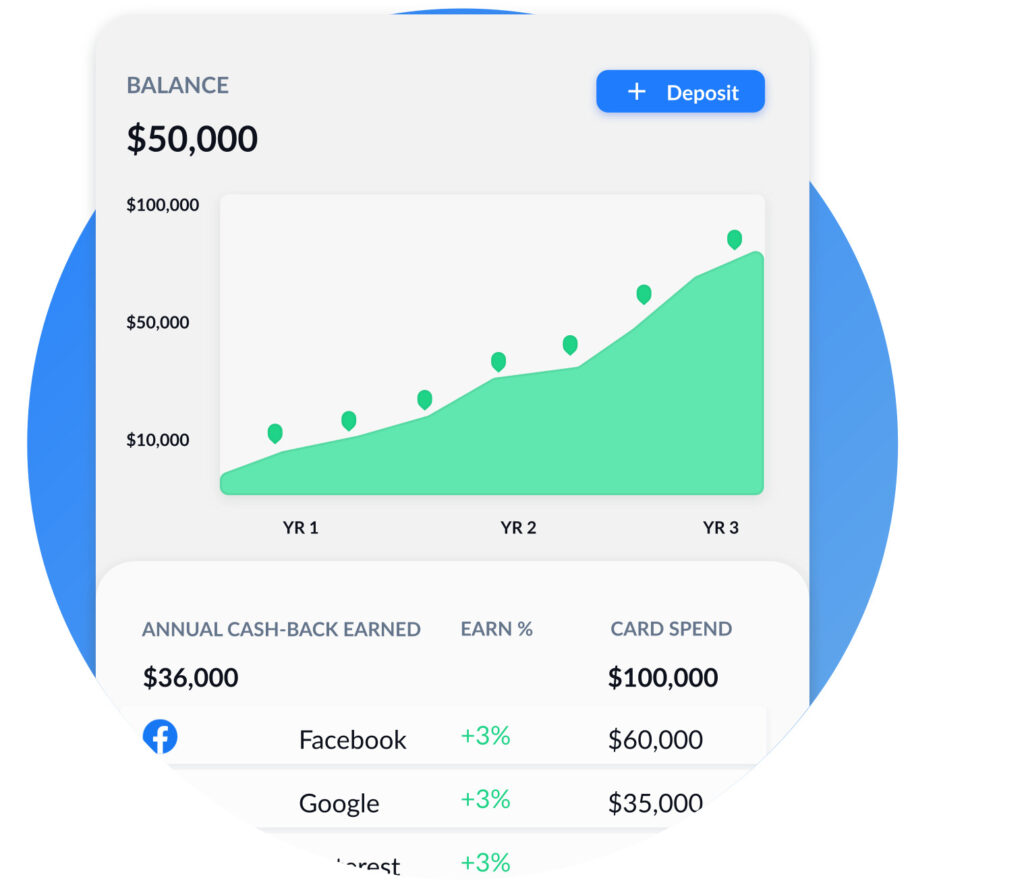

Randomvcc.com lets you easily control spend, get higher daily limits, earn cash rewards, and stabilize ad spend at scale.

Virtual Cards

Unlimited virtual cards with unique name, address, and zip code for each ad account, channel, and expense. Stabilize accounts with congruent card and account contact details.

Buying Power

Scale your ad spend through MasterCard's Premium BIN's, ensuring global acceptance across all networks.

Spend Controls

Get limit increases approved within minutes. Not days. Leverage our payments and credit expertise to grow your business faster.

Account Managers

Schedule a free audit with our expert media buying team at any time.